TR 20213 Income tax. 102014 which was issued on 31 December 2014 and subsequently amended on 11 May 2016 see Tax Alerts No.

Inland Revenue Board Of Malaysia Qualifying Expenditure And Computation Of Capital Allowances Public Ruling No 6 Pdf Free Download

122014 Date Of Publication.

. 122014 dated 31122014 and No. It is granted to a person who owns depreciable assets and use those assets in the production of income from business. Steps to Claim Accelerated Capital Allowance 11 9.

YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions as a place. And as todays map shows the extent to which businesses can deduct their capital investments varies greatly across european countries. 62015 Date Of Publication.

These are known as plant and machinery. Business losses brought forward. 27 August 2015 _____ withholding tax has been deducted and remitted to the Director General on the payment to the non-resident contractor in December 2015.

This initiative has further extended until 31 December 2021 under the National Economic. 3 Amended computation of residual expenditure for the year of assessment 2015 is made in the year of assessment. Objective The objective of this Public Ruling PR is to explain whether an asset is a qualifying plant and machinery for the purpose of claiming capital allowances in determining the statutory income from a business.

Statutory income from employment. September 23 2021 Post a Comment. Special Allowance For Small Value Assets Small Value Assets Slide No 06 The market capitalization rule is a regulation that places a floor on the total value of a companys stock for 30 consecutive days.

A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new ruling which is inconsistent with it. Application of the Law 1 5. Statutory income from rents.

ACCELERATE CAPITAL ALLOWANCE Public Ruling No. CAPITAL ALLOWANCE Public Ruling No. The Government has initially introduced special tax deduction on cost of renovation incurred from 1 March to 31 December 2020 in the first economic stimulus package announced by our former Prime Minister Tun Dr.

It is calculated in accordance with the provisions specified in the Third Schedule of the Act Income Tax Act 2015. 62019 Tax Treatment on Expenditure for Repairs and Renewals of Assets. You can claim capital allowances when you buy assets that you keep to use in your business for example.

Effective life of depreciating assets Withdrawn 1. 62015 dated 27 August 2015. COMPUTATION OF CAPITAL ALLOWANCES.

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie. Businesses will be allowed to carry back up to 100000 of current year unutilised capital allowances and trade losses to offset the income for the preceding three YAs - YAs 2018 2019 and 2020 enhanced carry-back relief or for only the immediate. Tax exemption under para 1273b or subsection 1273A of the ITA 1967.

27 August 2015 _____ Page 1 of 22 1. Superceded by Public Ruling No. Accelerated capital allowance under any rules made under section 154 of the ITA 1967 7.

Ownership Of Plant And Machinery For The Purpose Of Claiming Capital Allowances Superceded by Public Ruling No. Special Allowances for Small Value Assets dated 21 July 2021. As announced in Budget 2021 the enhanced carry-back relief will be extended to YA 2021.

Ruling applies from 1 July 2021. Statutory income from all businesses and partnerships. 6 Date Of Publication.

This ruling contains the Commissioners determination of the effective life for various depreciating assets. A capital allowance is an expenditure a uk. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

Income Tax Rules 2 8. This preview shows page 328 - 330 out of 765 pagespreview shows page 328 - 330 out of 765 pages. CLAIMING CAPITAL ALLOWANCES Public Ruling No.

Qualifying Expenditure 2 7. Relevant Provisions of the Law 1 3. The new PR comprises the following sections and sets out nine examples.

15 April 2013 Page 5 of 34 Forest Allowance Roads and buildings for timber extraction - 10 Living accommodation for workers 20 7. Procedure For Claiming Capital Allowances 28 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that Director General is empowered to make a public ruling in relation to the application of any provisions of ITA. The aca rules was gazetted on 5 july 2018 and is effective from year of assessment ya 2017.

The IRB has issued Public Ruling No. Mahathir Mohamad on 27 February 2020. Effective Date 25 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is.

72018 Date of Publication. 52014 dated 27 June 2014 - Refer Year 2014. COMPUTATION OF CAPITAL ALLOWANCES.

6 Date Of Publication. Qualifying expenditure QE QE includes. 3 Amended computation of residual expenditure for the year of assessment 2015 is made in the year of assessment.

COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. 27 August 2015 _____ withholding tax has been deducted and remitted to the Director General on the payment to the non-resident contractor in December 2015. This new 22-page PR replaces PR No.

31 December 2014 Page 1 of 12 1. TR 20211 Income tax. Public Ruling 42019 - Tax treatment of wholly partly irrecoverable debts and debt recoveries The IRB has iss ued Public Ruling 42019 - Tax Treatment of Wholly Partly.

The IRB has recently issued PR No. A Public Ruling is published as a guide for the public and officers of the Inland. 8 Oktober 2018 CONTENTS Page 1.

Effective life of depreciating assets. Other than those which qualify for capital allowances under Schedule 3 of the ITA The cost of reconstructing or rebuilding any premises buildings structures or works of a permanent nature and the cost of any plant or machinery. Objective The objective of this Public Ruling PR is to explain a tax treatment in relation to qualifying expenditure on plant and machinery for the purpose of claiming capital allowances.

This is a standardised deductible allowance in place of Financial Accounting depreciation. Ratings 100 2 2 out of 2 people found this document helpful. 22001 COMPUTATION OF INITIAL ANNUAL ALLOWANCES IN RESPECT OF PLANT MACHINERY 10 TAX LAW This Ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15 Schedule 3 Income Tax Act 1967 and the Income Tax Qualifying Plant Annual Allowances Rules 2000 PUA 522000.

Capital allowance Industrial building allowance 25 11. You can deduct some or. Special Rates Of Allowances Special rates of allowances provided under Schedule 3 of ITA 1967 and Income Tax Rules may be categorized to accelerated capital.

Public Ruling Capital Allowance.

Joint And Separate Assessment Acca Global

Income Tax Accounting Hot Topics Year End 2020 Bdo

.jpg)

Financing And Leases Tax Treatment Acca Global

Reinvestment Allowance 2012 Inland Revenue Board Malaysia

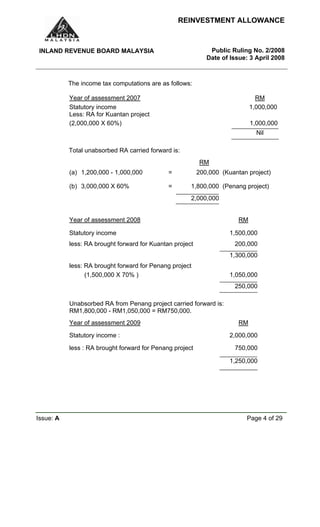

Reinvestment Allowance 2008 Inland Revenue

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Important Notes To Our Valued Cy Business Management Facebook

Inland Revenue Board Of Malaysia Malaysian Institute Of Accountants

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Public Ruling No 5 2015 Taxation Of Limited Liability Partnership 营商攻略

.jpg)

Financing And Leases Tax Treatment Acca Global

Pwc Alert Issue 125 Of Computer Software And Capital Allowance Claims

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

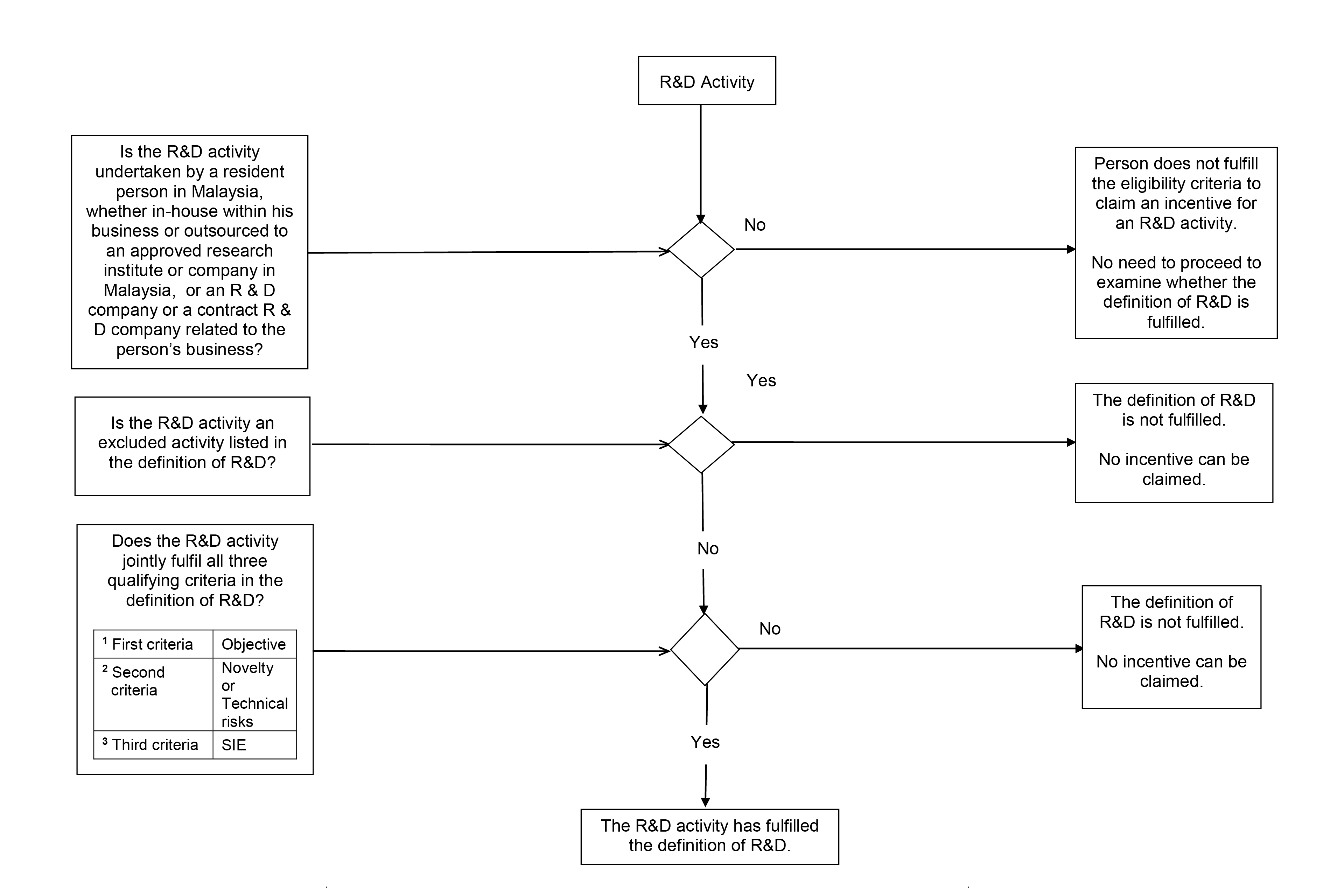

Prs And Technical Guidelines On The Tax Treatment Of R D Expenditure Ey Malaysia

What Is Capital Allowance And Industrial Building Allowance How To Claim Them Anc Group

Inland Revenue Board Of Malaysia Qualifying Expenditure And Computation Of Capital Allowances Public Ruling No 6 Pdf Free Download

Internal Revenue Bulletin 2020 29 Internal Revenue Service

Time To Revisit Your Reinvestment Allowance Claim Thannees Articles